|

|

Navigation: Previous Page | Contents | Next Page

Dissenting Report by Coalition Members and Senators

1. Lack of Transparency on NBN Build Costs

- The capital cost of

the NBN fibre roll out per premise is the single most important determinant of

the implications of the Government’s policy for end user broadband and

telephony prices over time.

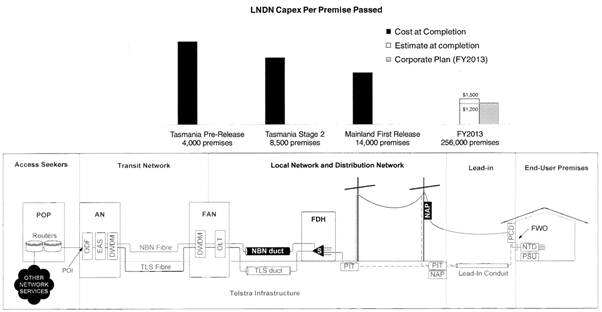

- In the October Joint

Committee on the NBN hearing and again in February estimates, NBN Co presented

an indicative breakdown of the cost per premise passed of the fibre local

network and distribution network. Indicative costs have been provided for the

rollout so far, and for what NBN Co forecasts costs per premise will be in

2013.

- The relevant slide is

included below:

- While these slides

provide at least some information, it is important to note the data that

matters – on premises which have been completed – is not transparent. On the

contrary it is deliberately imprecise. The graphs suggest per premise costs

are coming down. But they do not provide dollar figures for what actual costs

have been incurred so far during each phase of the rollout, nor how these

compare to the originally budgeted figures.

- The most important

capex cost information (the estimate for the ‘volume rollout’ which will

account for most fibre deployed) is just a prospective estimate – there is no

real world data provided.

- The graph does allow

a rough comparison of capex costs in each construction phase so far as a

multiple of the per premise FTTP cost estimated n the NBN Co Corporate Plan:

- Tasmania

Pre Release – 4.125x

- Tasmania

Stage 2 – 3.25x

- Mainland

First Release – 2.5x

- Volume

Rollout (FY2012-13 Forecast) – 1.25x

- In each case the

figure is substantially higher than the current NBN Co budget.

- Additionally, the NBN

graph provided to Parliament does not in fact provide a comprehensive estimate

of per premise costs for NBN Co’s FTTP. Rather it is an estimate of costs

across a portion of the fibre network – the local network and distribution

network; in layman’s terms, what it’s costing to get fibre from the exchange to

the street corner.

- The figures thus

exclude the capex associated with running fibre through the lead-in conduit (or

overhead from a pole) or equipment and installation costs associated with

terminating the network at the end-user premises.

- The NBN has also

responded to a question on notice regarding the cost per premise of the NBN’s

fibre network by refusing to detail costs. In its response, NBN Co stated:

- “NBN Co’s Chief Financial Officer, Mr Robin Payne, provided

information relating to cost per premises and cost trends at the JCNBN hearing

on 30 October 2012 (Hansard pp.6-7). Also, Mr Quigley has previously provided

information about why cost-per-premises figures can be commercially sensitive,

particularly when construction procurement processes are underway. Please see

October 2011 JCNBN Hearing Hansard pp. 21-22.”[1]

- The fully allocated

capital cost of FTTP per premise is both crucial to the economics of the

network and highly variable. Evidence from other markets suggests the average

figure over a substantial deployment can be as little as <$500 in the case

of fibre rolled out by incumbents in densely populated cities with well

maintained and expansively designed underground ducts to >$5000 in the case

of FTTP serving very low density areas or in challenging terrain.

- The 2012-2015 NBN

Corporate Plan appears to be predicated on an average capex spend (including

full allocation of all capex shared across the NBN’s three networks) of

approximately $2700 per premise within the fibre footprint.

- The Coalition

acknowledges some areas of investment will appear high if reported on a current

per premise basis, because assets such as the fibre transit network are being

built up front but will eventually be amortized over larger numbers of premises

than at present. Any resulting distortions can be corrected by explicitly

breaking capex into shared and per premise components, and making transparent,

reasonable assumptions about amortization of the former.

- NBN Co has chosen not

to release any of this information either to Parliament or taxpayers.

Therefore at present there is no visibility into whether NBN Co’s capex

estimates are plausible or not.

- The bottom line is

that Australia’s largest infrastructure project in history is a black box. The

Gillard Government and NBN Co are simply refusing to disclose the actual

evidence on deployment costs that must surely exist in robust form after

running fibre past 82,000 premises. Taxpayers funding the project have every

reason to question why they would not be provided with this data.

- The right hand bar of

this slide is labelled “FY2013 256,000 premises’ and shows two numbers, $1500

and $1200. When read in conjunction with the other (unlabelled) bars showing

much higher capex per premise at earlier stages of the rollout, the slide is evidently

intended to convey the impression that capex per premises passed will be in the

range $1200-1500 by the end of FY2013.

- During the hearing

officials of NBN sought to reinforce the impression that the capex per premises

passed would be reduced to this level by quoting the experience of Chorus in

New Zealand.

Mr Quigley: What is very important for the committee

is the number on the right. Obviously, what is important is that it has come

down substantially. There were low numbers to start with. With the number on

the right we are saying that with our corporate plan—as you can see in the

yellow there—given our best estimate now and given all the data we have, that

we are confident that we are going to come in for FY2013 between $1,200 and

$1,500 for this component of the cost per premise passed, which is consistent

with the data you would have seen in New Zealand.

Mr Payne: I think that Chorus from New Zealand have fairly recently published data showing that cost per premise is falling from

around $3,300 last year to $2,700, $2,900 this year. They are targeting, I

think, around $1,200 to $1,500 in the long run.[2]

- In September 2012

Chorus published a document showing it expects connection costs per premises to

fall[3]. It

shows a current cost per premises of $3,300 – and it not dropping to a rate of

$1200-1500 until 2020.

- Coalition members

consider that it is misleading of Mr Quigley to suggest that the experience of

Chorus in New Zealand supports NBN Co’s forecast of reaching a cost per

premises passed of $1200 to $1500 by the end of FY2013. On the contrary, the

Chorus experience suggests that it will take many years, and a rollout volume

substantially higher than NBN Co has achieved, before it is able to reduce the

cost per premises to this level.

- It is also worth

bearing in mind that labour costs in New Zealand are materially lower than they

are in Australia.

Recommendations

- NBN Co to immediately

publish full capital expenditure figures per premise (including all direct

costs of the relevant network, and an explicit and transparent allocation of

transit and other shared or indirect capital costs between currently passed and

future premises) for:

- The

cohort of premises passed with fibre in brownfield areas.

- The

cohort of premises passed with fibre in greenfield areas.

- The

cohort of premises covered by the fixed wireless network.

- NBN Co should also

provide a comparison against the assumed costs contained in the 2012-15

Corporate Plan and should publish trends in cost over time so that it is able

to assess the extent to which the NBN Co’s ‘learning curves’ have led to gains.

2. Telcos Raise Concerns Over Proposed NBN Price Hikes

- Modelling conducted

by Optus and submitted to the ACCC suggest that under the current Special

Access Undertaking proposed by the NBN Co to the ACCC, it is likely that there

will be significant fixed line price increases after a long period of falling

prices.

- Assuming fixed

broadband usage (in terms of data volumes) increases by around 28 per cent per

year which is its current trend, Optus found the SAU and NBN Co’s proposed

pricing will drive a 32.3% increase in real prices for end users over the next

decade[4].

- Telstra

wrote to the ACCC stating that if usage grew 1 per cent per year, prices would

rise 3 per cent, but “using the more realistic assumption that usage increases

by 30 per cent per annum, the CAGR for the basket of AVC and CVC services

purchased by end-users is 19 per cent”[5]. The monthly price of wholesale broadband (across a

basket of plans) would rise from $28 in 2013 to $145 in 2028.

- Additionally, it is

concerning to Coalition members that the NBN Co has explicitly acknowledged

that its current prices reflect neither its costs, nor the charges needed to

recover its reasonable costs and make the return on invested capital that has

been claimed by the Government.

- On

January 14, 2013, the NBN Co’s General Manager Engagement and Group

Coordination Richard Home stated in a letter lodged with the ACCC: “The initial prices (as set out in the SAU) were developed in

consultation with access seekers so as to enable a smooth transition for end

users from legacy networks to the NBN. As such the initial prices are not

the result of modeling of NBN Co’s costs and demand and NBN Co has been very

clear on this in its consultation with access seekers.”[6]

- The

implication of this admission for consumers is that the Government’s frequent

assertions that prices for ADSL2+ equivalent services over the NBN will remain

at current levels have no basis in economic reality.

Recommendations

- That the Government

submit the NBN project to a rigorous cost benefit analysis.

- That such an analysis

include credible estimates of construction costs that incorporate actual

construction data, credible estimates of revenues given current trends in the

global telecommunications market, and the resulting implications for end user prices

given NBN Co’s currently proposed SAU and pricing.

- That the Government

investigate means of delivering super fast broadband that permit a more prudent

level of investment, and hence less pressure from NBN Co for regulatory

settings that enable aggressive uplift and recovery of costs through rapid

increases in real revenue per user.

3. Analysts Question Whether Corporate Plan Revenues Achievable

- In August 2011 RBS analyst Ian Martin wrote in the Telecommunications

Journal of Australia[7]that NBN Co’s corporate plan appeared risky if taken at face value.

Risks to the Corporate Plan included cost blowouts building the NBN; and the

danger NBN Co may not meet its take-up targets (exacerbated by a very low

forecast of ‘wireless-only’ households in 10 years time).

- Other analysts have raised concerns that the NBN will

not be able to reverse the global telecommunications trend of the past decade

which has seen nominal revenues flatline despite huge increases in speeds and

data offered to customers.

- For instance, in August 2007 TPG offered an

18GB cap at $49.99. In 2013 it offers a 500GB cap at $49.99. Users have

enjoyed more and more data for the same price.

- NBN Co, in contrast, expects to lift monthly wholesale

revenue from $24 in FY2012 to $63 in FY2021.[8] Adjusted for inflation, revenue

per user more than doubles in nine years.

- UK analyst Robert Kenny recently wrote: “They [NBN Co] expect consumers to be willing to pay substantially

more to get higher speeds, with a result that the typical user increases their

spend by about 70% over the next decade. While it is intuitive that consumers

might pay more for higher speeds, as we have seen historically they haven't had

to.”[9]

- There are also

questions about NBN Co’s projected revenues vis a vis the likely future size of

the entire Australian fixed line broadband and telephony market.

- Deutsche Bank analyst

Vikas Gour[10]

in October 2012 released research implicitly suggesting NBN Co’s actual

revenues could be below estimates. He forecast four retail service

providers (Telstra, Optus, TPG and iiNet) with 96 per cent of the market in

FY2024 would pay $3.8 billion to NBN Co in access fees that year.[11]

- Yet the NBN Co 2012-2015 Corporate Plan projects revenues

of $6.2 billion in FY2021 and $9.8 billion in FY2028.[12] This equates to

$7.9 billion in FY2024 if growth is assumed to be linear between NBN Co’s two

explicit estimates.

- Bluntly, NBN Co’s internal estimate of the 2024 fixed line

market, which relies on revenue per user increasing 9 per cent above the

inflation rate each year over a period of more than a decade , is twice as

large as that of a respected securities analyst whose work is subject to close

financial market scrutiny.

- A JP Morgan report on

Telstra[13]

projects in FY 2020 it will pay NBN Co $1.7 billion

for access and have a retail market share of 39 per cent. That implies access

revenue for the whole market of $4.4 billion. It compares to NBN Co’s FY2020

revenue estimate of $5.2 billion.

- The uncertain economic viability of the NBN is a large

potential liability for future Governments. NBN Co Chairman Harrison Young has

stated there is no legal requirement to provide taxpayers with a particular

return on investment : “Our Shareholder hasn't given us a return hurdle.

They've given us a task and asked us to keep them posted.”[14]

Recommendations

- That the NBN’s

modelling, analysis and detailed financial projections of its capital and

operating costs, and of future end user prices and demand, be made public.

4. Rollout Delays - Problems With Contractor Syntheo

- In 83 FSAMs where

construction of the fibre network began between June 2011 and March 2012, there

have been extensive delays.

- The ‘Monthly Ready

for Service’ rollout plans published on the NBN website showed that as of June,

the estimated construction timeframe to completion was 14.8 months on those 83

FSAMs.

- By December, the

average construction timeframe was 16.5 months with the vast majority FSAMs

still to be activated.

- At a recent estimates

hearing, NBN Co CEO Mike Quigley also said that forecasts for June 30 have had

to be revised down:

“You will also notice, if you look carefully there, that we

have slightly lowered the number of premises forecast to be passed by the end

of June 2013. In October we were forecasting just under 300,000 premises

passed; we are now forecasting almost exactly the target of 286,000. The reason

for the change is that one of our construction partners has significantly

reduced its forecast since we presented back in the October time frame.”[15]

- Mr Quigley said that

these revisions were due to the contractor for the Western Australia, South

Australia and Northern Territory rollout, Syntheo. On 25 FSAMs that Syntheo

began construction on between June 2011 and March 2012, not a single one is

ready for service.

- Mr Quigley also said

NBN Co has already paid its contractor Syntheo pre-payments, as is usual for

large construction contracts, and has a range of contractual protections

against non-delivery but refused to elaborate on them:

“Senator BIRMINGHAM: What contingencies does NBN Co.

have in place where contractors fail to meet their targets?

Mr Quigley: We have a range of the usual commercial

conditions you would expect in such contracts if a contractor is in default.

Senator HEFFERNAN: Such as?

Mr Quigley: We apply, obviously, penalties. We are not

going into details of the contracts.

Senator Conroy: This is a hypothetical question. The

company are not in default.

Mr Quigley: No, they are not in default.

Senator HEFFERNAN: Do they get paid in arrears or—

CHAIR: Order, Senator Heffernan! You do not have the

call.

Senator HEFFERNAN: I think it is a fair question to

ask.

Senator Conroy: You are asking

commercial-in-confidence questions.

Senator BIRMINGHAM: What is the nature of payments

made to Syntheo? Are there up-front payments made?

Mr Quigley: Yes, there are up-front payments made for

mobilisation for all of our construction contractors.

Senator BIRMINGHAM: Can you talk us through the

different types of payments that are made?

Mr Quigley: The payments are phased relative to the

different phases of the project. There is a design phase, then there is a build

phase, and there are various phases in the build. The payments are obviously

paid at the different phases, as they are completed.

Senator BIRMINGHAM: What payments have been made to

Syntheo to date in relation to these 25 FSAMs?

Mr Quigley: I do not have that number with me. There

have obviously been some payments made for the designs of each of those FSAMs

and some mobilisation payments. I could not give you the number off the top of

my head. I would have to take that one on notice.”[16]

Recommendations

- The NBN Co and

Government should urgently explore ways of speeding up deployment of super fast

broadband.

5. NBN Struggling to Connect to Multi Dwelling Units

- In May 2011, the NBN Co put out a request for

proposals for MDU cablers. The RFP stated the NBN was looking for companies to

carry out “installing fibre cabling and equipment within common areas of

existing MDUs using pre-supplied detailed designs and bills of material”[17].

- As of October 2012,

the NBN had still not signed contracts to connect MDUs. At a public hearing

into the NBN, the NBN Co’s Chief Operating Officer Ralph Steffens said:

“Mr Steffens: We are in trials with a number of

contractors. We are about to award the contracts for the MDUs.

Mr TURNBULL: Yes. Can you tell us who those

contractors are?

Mr Steffens: No, because we have not concluded it.

The number of MDUs passed I would need to take on notice.”[18]

- Mr Steffens also said

that the NBN Co has a particular problem with mapping information when it comes

to MDUs: “It varies dramatically, not only between the geography but also

between the types of premises. Multi dwelling units are typically a lot more

inaccurate than single-dwelling units. It is a significant percentage, but

there is a huge variety between the geographies.”[19]

- The NBN noted in its

2012 corporate plan that the difficulty in connecting MDUs has led to increased

capital costs: “NBN Co’s experience in initial deployment sites has highlighted

the challenges for connecting premises in MDUs and additional costs have

therefore been embedded in the 2012-15 Corporate Plan.”[20]

- The NBN stated in an

answer to questions on notice that only a very small percentage of MDUs passed

have been connected:

“As at 7 December 2012, more than one-third (35 per cent) of

Brownfields residential MDUs passed by the NBN either had an active service or

were able to order an active service. The definition of MDUs (refer page 93 of

the NBN Co Corporate Plan 2012-15) ranges from duplex type premises to 200 plus

unit apartment blocks. NBN is currently trialling different connection methods

in MDUs nationally in First Release Sites. The learnings from these trials to

date have led to some revisions in the scope of work to connect these premises

in a more efficient and cost effective manner. Many require a bespoke solution

different to single-dwelling units (SDUs) and this has resulted in some delays

is servicing these premises. NBN Co is working with the industry to provide

regular information to MDU owner's corporations and residents ahead of

connections. NBN Co is currently in negotiations with a number of specialist

contractors to supply project management, design and installation of fibre into

these premises. Field work commencement is imminent.”[21]

- The NBN also stated:

“As at 7 December 2012, there were 137 active connections in brownfields

residential MDUs”.[22]

- Two weeks later, the NBN Co issued a

press release which claimed the network had connected an additional 100 MDUs in

just two weeks: “So far NBN Co has rolled out the network to 237 residential

MDUs across Australia, with work underway on a further 131.”[23]

- On December 21, 2012,

the NBN Co signed a contract with construction firm Downer EDI and Universal

Communications Group Limited to service MDUs. The contracts were worth $87

million in total and will cover 17,600 blocks of apartments across four states and territories over the

next two years.[24]

- The NBN has also

created a national register for Multi Dwelling Unit strata managers to

coordinate connections to the network[25].

- However, it is of

concern that the NBN has still not signed contracts to connect MDUs in Western

Australia, South Australia and the Northern Territory.

- It is also unclear

whether the 17,600 blocks of apartments will cover the entire network build

over the next two years. The NBN Co has forecast that it will pass 1.1m

premises by the end of June 2014 in the fibre brownfields footprint and will

pass 178,000 premises in the fibre greenfields footprint.

- The NBN implementation

study found that MDUs account for 34 per cent of premises in Australia[26]. There are

431,000 buildings with 2-5 premises, accounting for a total of 1.135m

premises. There are 119,000 buildings with 5-25 premises, accounting for a

total of 1.268m premises. And there are 20,000 buildings with 25 or more

premises, accounting for a total of 1.211m premises.

- NBN Co’s current

contracts cover only 3 per cent of Multi Dwelling Unit buildings in Australia.

Recommendations

- The NBN is to publish

a register of all MDUs already ‘passed’ by the network, but which are unable to

connect to the network, to allow residents and body corporates to see when

services will become available.

- If an MDU building

cannot connect to the network, those figures should be excluded from the

figures reported as ‘premises passed’.

- The NBN should

immediately investigate international experience of connecting MDUs using

existing internal wiring, including Fibre to the Basement.

- The Shareholder

Minister’s Statement of Expectations to the NBN Co should be amended so that

the NBN Co is no longer expected to terminate the fibre at each individual

premises. The NBN Co should be given scope to terminate the fibre at an

appropriate distance from the end user’s premises, as would still allow the

delivery of very fast broadband.

6. NBN and DBCDE Spending Excessively on Advertising Without Measuring

Effectiveness

- In May 2012

estimates, the NBN claimed its overall marketing spend for 2011-12 would be

$8.12 million.[27]

- Yet in its annual

report, the NBN listed ‘Communication and marketing

campaigns’ as having cost $11.226 million in 2011-12[28]. This

represents a 38 per cent blowout in what was reported to Estimates in May.

- Recent media reports

revealed various Government departments have spent $29 million on NBN-related

advertising since 2010 and that the Department is planning a further $20

million spend in 2012-13[29].

- The NBN has stated

that its media expenditure is forecast to be approximately $11.9 million for

2012-13[30].

- Given that the NBN is

forecasting 78,500 net subscriber gains in 2012-13, this level of expenditure

appears excessive. For each new customer, the NBN Co will spend more than $150

on advertising and the DBCDE will spend more than $250 on advertising.

- It is also important

to note that the NBN is not selling services direct to consumers. So the NBN’s

advertising is on top of the money spent by RSPs who ultimately form the

relationship with individual customers.

- In addition, the NBN Co

employees 52 staff in its media/communications division[31]. As at June 30, the NBN

Co’s entire staff headcount was 1,674[32],

so the proportion of media and communications staff is very high.

- By comparison, ACMA

employs 15 media and communications staff members, the DBCDE employs 23 media

and communications staff and the Department of Education, Employment and

Workplace Relations employs 51 media and communications staff[33].

- It is also alarming

that Senator Stephen Conroy continues to misrepresent the NBN Committee’s

unanimous support for the advertising campaign. In October Estimates Senator

Conroy said: “The additional opex is also in part due to increased resources

at NBN Co. for public information campaigns—something you personally supported

in the joint parliamentary committee, as did Mr Turnbull. Let us not forget

that that was your recommendation, and NBN Co. has done just that.”[34]

- In fact, nothing

could be further from the truth. In the Third Progress Report on the NBN

issued by the Joint Committee, Coalition members issued a dissenting report

which included a recommendation stating: “The Government and NBN Co conduct a

review of its advertising spending for effectiveness and measure this against

uptake and other relevant metrics. Expenditure should be reduced unless it can

be demonstrated as providing value for money. The NBN Co should refrain from

advertising Stage One of the fibre rollout in suburbs and regional areas which

have not been included in the Stage One schedule”[35].

- Announcing an

additional $15 million spend by the Government in 2012-13, the Age

reported Joint Committee chairman Rob Oakeshott said the committee did not

recommend more advertising and the upcoming campaign would have to be a ''much

better standard of advertising than we have seen to date'' to justify the $14.7

million price tag. He said the last NBN campaign was “bland, blancmange and

shameless … that in the eyes of many was a waste of money”[36].

Coalition Criticism of NBN Advertising Campaigns

- Promotional material

was published in regions not included in stage one of the rollout, creating

confusion over when the NBN will be available[37].

- Much of the material

created a false impression that many services and applications that are of

public benefit can only be delivered on a fibre-to-the-premise network[38].

- There was

insufficient focus on pressing public interest issues, such as the

decommissioning of the copper network and the lack of RSPs offering services

over the NBN’s Uni-V ports.

Recommendations

- The NBN Co and the

DBCDE need to measure the effectiveness of their overall advertising and

marketing spending, to justify any ongoing increases.

- Both the NBN Co and

the DBCDE should conduct research into public perceptions and understanding of

key policy issues such as:

- The

looming decommissioning of the copper network in areas where FSAMs are active.

- Retail

offerings for essential services, such as analogue medical device connections.

- A home

owners’ responsibility in terms of replacing battery back-ups.

- If the research shows

deficient community awareness of key public interest topics, the current

spending on marketing and promotion of the NBN need to be redirected to address

them.

7. NBN Looking to Sign Longer Contract Periods

- It was reported last

October that the NBN is investigating extending the contract period for future

contracts to fixed four year terms[39].

- In recent estimates

the NBN refused to comment on current contract negotiations:

“Mr Quigley: We are in the process of having

discussions with all of our contractors. I cannot give you a date when they

will be concluded or contracts signed. Obviously with all of our contracts we

look to renewing them as they fall due.

Senator BIRMINGHAM: The initial contracts were on the

basis of two year plus one plus one year?

Mr Quigley: With the construction contractors, yes.

Senator BIRMINGHAM: Is NBN Co. looking at a variance

to that for the renewables?

Mr Quigley: We may. Until we finish the discussions I cannot

give you an answer on that.

Senator BIRMINGHAM: Are reports that you are offering

fixed four-year terms for contractors correct?

Mr Quigley: I will not comment on what we may or may

not be offering with particular contractors.

Senator BIRMINGHAM: Why is NBN Co. looking at changing

its contract periods?

Mr Quigley: We only look at changing contract periods

if we believe there is an advantage to NBN Co. to do so—in other words, we can

get the build done with greater certainty and at a lower rate.

Senator BIRMINGHAM: When does NBN Co. need to resolve

those contracts by?

Mr Quigley: I suspect we will want to have some of

them that are falling due in the middle of this year done before then. We need

to renew them before then.”[40]

Recommendations

- The benefits of

changing contract terms in the lead up to the September 14 election need to be

clearly articulated by the NBN Co.

- The NBN Co and its

board should be clearly mindful of a possibility of a change of Government and

the need to alter contracts down the contract. The NBN Co and its board should

ensure suitable flexibility is written into the terms of future contracts. If

this is not possible, then the likely costs of changing and lengthening

contract terms need to be weighed against perceived benefits.

8. Lack of Transparency and Accountability in Reporting to the Committee

Take-up Rates

- Take-up rates have a

direct bearing on the rate of return for the NBN project, even when taking into

account the fact that NBN Co will eventually be the national monopoly wholesale

provider of fixed line broadband and voice services. Therefore, accurate and

regular reporting of take-up rates is necessary for the Committee to understand

the true state of the NBN rollout.

- To date, reporting of

take-up rates by NBN Co has been unsatisfactory. NBN Co provided the following

response to the Committee, after being asked in September 2012 to provide daily

activation rates for the NBN fibre network:

- “NBN Co has not done this calculation as it is not meaningful

at this stage of the roll-out based on a number of factors impacting the

calculation including the time taken to finalise the Definitive Agreements.

With the Definitive Agreements now unconditional and NBN Co able to ramp up the

rollout of the NBN fibre network, NBN Go's 2012-15 Corporate Plan is

forecasting a daily run rate for FY2013 of up to 201 (pg 37 refers) for fibre

premises connected.[41]

- NBN Co bills RSPs for

each customer they connect to the NBN network, so it is extremely unlikely that

NBN Co cannot provide accurate and timely figures for the number of customers

connected to the network in a given period of time. Indeed, if it cannot

provide such figures, the Committee is entitled to ask how the company is

accurately billing RSPs.

Combining ISS and Wireless in Premises Passed/Covered Figures

- NBN Co has at times

included premises passed by the NBN Interim Satellite Service (ISS) with

premises passed by the wireless network when reporting to the Committee.[42] Combining

premises passed figures for the ISS and wireless networks does not allow the

Committee to develop a clear picture of how the network rollout is progressing.

Inaccurate and Delayed Answers to Questions

- NBN Co has, on many

occasions, failed to either answer questions accurately or to provide answers

within the requested timeframe, or both. This failure to provide timely and

accurate answers to questions severely hampers the Committee’s ability to

properly report to Parliament on the progress of the NBN project, as required

by the Committee’s Resolution of Appointment.

- By way of example, Mr

Hartsuyker placed questions 19 and 20 on notice following the public hearing on

16 April 2012. The questions related to additional costs incurred by NBN Co to

prepare the Bonnyrigg greenfields development in western Sydney for fibre

installation. NBN Co provided answers in early June, which were not entirely

accurate. The Committee sought clarification from NBN Co on 26 June 2012. The

Minister responded on 10 August with new information, some of which

contradicted the initial answers given by NBN Co. The Committee sought further

clarification about the contradictory answers on 16 August, with a final

response received by the Committee on 20 August 2012. The outcome of this

series of events was that it took four months to obtain accurate answers to a

small number of relatively straightforward questions.

- As a result of the

example above, and other instances of inaccurate or delayed responses from NBN

Co, it is difficult not to conclude that NBN Co and the Shareholder Ministers

are at best seeking to avoid scrutiny of the NBN project, or at worst,

systematically limiting the Committee’s ability to carry out its functions

effectively.

Recommendation

- NBN Co provide the

JCNBN with a standard monthly progress report not more than ten days after the

end of each month, setting out the number of premises passed in the previous

month by the fibre network, the number of premises passed in the previous month

by the wireless network, and the number of premises that were connected to the

network on each of the fibre, wireless, and satellite networks, and at what

speed tier.

Hon

Malcolm Turnbull MP

Member

for Wentworth

on

behalf of the Coalition Members of the Joint Committee

on the National Broadband Network

|

|